Delve into the realm of Orum Fintech and Payment Security Standards where intricate details meet a robust framework. This introduction invites readers to explore a world of cutting-edge technology and regulatory compliance, ensuring a comprehensive understanding of the topic at hand.

The subsequent paragraph will provide a detailed overview of the core services and target market of Orum Fintech, setting the stage for a deep dive into the realm of payment security standards.

Overview of Orum Fintech

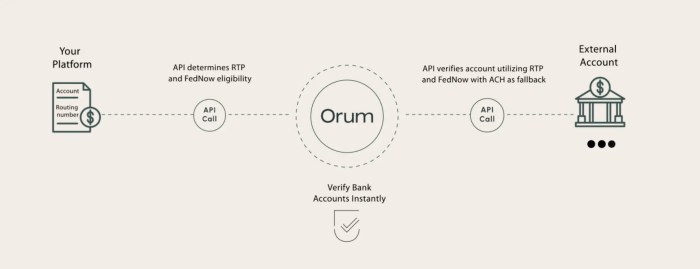

Orum Fintech is a leading financial technology company that specializes in providing innovative solutions for payment security and efficiency in the financial sector.Core Services Provided by Orum Fintech

- Real-time fraud detection and prevention: Orum Fintech offers advanced algorithms and machine learning capabilities to protect against fraudulent activities in payment transactions.

- Payment optimization: Orum Fintech's solutions help streamline payment processes, reduce costs, and improve overall operational efficiency for businesses.

- Transaction monitoring: The company provides tools to monitor and analyze payment transactions in real-time, ensuring compliance with security standards and regulations.

Target Market for Orum Fintech’s Solutions

Orum Fintech primarily caters to financial institutions, banks, payment processors, and e-commerce platforms that require secure and efficient payment processing solutions. The company's services are designed to meet the needs of organizations looking to enhance their payment security measures and optimize their financial operations.Importance of Payment Security Standards

Adhering to payment security standards is crucial in the fintech industry to protect sensitive financial information, prevent fraud, and build trust with customers. By following these standards, companies can ensure that transactions are secure, maintain compliance with regulations, and mitigate risks associated with cybersecurity threats.

Adhering to payment security standards is crucial in the fintech industry to protect sensitive financial information, prevent fraud, and build trust with customers. By following these standards, companies can ensure that transactions are secure, maintain compliance with regulations, and mitigate risks associated with cybersecurity threats.Examples of Security Standards

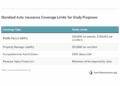

- PCI DSS (Payment Card Industry Data Security Standard): A set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment.

- ISO 27001: An international standard that provides requirements for establishing, implementing, maintaining, and continually improving an information security management system.

- EMV (Europay, Mastercard, Visa): A global standard for credit and debit card payments based on chip card technology, which helps reduce the risk of counterfeit fraud.

- Tokenization: The process of replacing sensitive data with unique identification symbols (tokens) to protect card information during transactions.

Compliance Regulations for Fintech Companies

Compliance regulations are essential for ensuring the security and integrity of financial transactions, especially in the fintech sector. Orum Fintech must adhere to specific regulatory requirements to protect customer data and prevent fraudulent activities.

Regulatory Requirements for Orum Fintech

Orum Fintech needs to comply with various regulations, including:

- PCI DSS (Payment Card Industry Data Security Standard): This standard ensures that companies that accept, process, store, or transmit credit card information maintain a secure environment.

- GDPR (General Data Protection Regulation): Orum Fintech must protect the personal data of EU citizens and ensure that data is collected and processed legally and transparently.

- AML (Anti-Money Laundering) Regulations: Orum Fintech must implement measures to prevent money laundering and terrorist financing activities.

Comparison with Traditional Financial Institutions

While traditional financial institutions also need to comply with regulations like PCI DSS and AML, fintech companies face additional challenges due to their innovative nature and reliance on technology. Fintech companies often operate across borders and deal with a higher volume of online transactions, requiring robust cybersecurity measures.

Technologies Utilized for Ensuring Payment Security

Orum Fintech employs a variety of cutting-edge technology tools and solutions to ensure the highest level of payment security for its users. These technologies play a crucial role in preventing fraud and enhancing transaction security.

Tokenization

Tokenization is a key technology used by Orum Fintech to secure payment data. It involves replacing sensitive information with a unique identifier, known as a token, which is meaningless to hackers. This ensures that even if the data is intercepted, it cannot be used to make unauthorized transactions.

Encryption

Encryption is another essential technology utilized by Orum Fintech to protect payment information. By converting data into a code that can only be decoded with the right encryption key, sensitive details such as credit card numbers are safeguarded from unauthorized access.

Multi-Factor Authentication (MFA)

Orum Fintech implements multi-factor authentication to add an extra layer of security to payment transactions. This involves requiring users to provide multiple forms of verification, such as passwords, biometric data, or SMS codes, before completing a transaction. MFA significantly reduces the risk of unauthorized access.

Machine Learning and AI

Machine learning algorithms and artificial intelligence are utilized by Orum Fintech to detect patterns and anomalies in payment data that may indicate fraudulent activity. By analyzing vast amounts of data in real-time, these technologies help in identifying and preventing fraudulent transactions before they occur.

Data Encryption and Secure Transactions

Data encryption plays a crucial role in securing transactions for Orum Fintech by ensuring that sensitive financial data is protected from unauthorized access. By encrypting data, Orum Fintech can provide a secure environment for conducting transactions and safeguarding customer information.End-to-End Encryption Process

To ensure end-to-end encryption for sensitive financial data, Orum Fintech implements robust encryption protocols that encrypt data at every stage of the transaction process. This includes encrypting data when it is transmitted from the user's device to Orum Fintech's servers, as well as when it is stored in databases. By encrypting data both in transit and at rest, Orum Fintech can maintain the confidentiality and integrity of customer information throughout the entire transaction lifecycle.- Orum Fintech utilizes industry-standard encryption algorithms such as AES (Advanced Encryption Standard) to secure data both in transit and at rest.

- Secure communication channels such as SSL/TLS protocols are employed to encrypt data during transmission, ensuring that sensitive information is protected from interception by malicious actors.

- Multi-factor authentication mechanisms further enhance security by requiring additional verification steps to access encrypted data, adding an extra layer of protection against unauthorized access.

Fraud Prevention Measures

Detection and Monitoring Systems

Orum Fintech utilizes advanced detection and monitoring systems to identify any suspicious activities in real-time. These systems analyze transaction data, user behavior, and patterns to flag any anomalies that could indicate fraudulent behavior.Biometric Authentication

To enhance security, Orum Fintech incorporates biometric authentication methods such as fingerprint scanning or facial recognition. This adds an extra layer of protection to verify the identity of users and prevent unauthorized access to accounts.Machine Learning Algorithms

By leveraging machine learning algorithms, Orum Fintech can continuously improve its fraud detection capabilities. These algorithms analyze historical data to identify new trends and patterns associated with fraudulent activities, allowing for proactive prevention measures.Multi-factor Authentication

Another key strategy employed by Orum Fintech is multi-factor authentication, requiring users to provide multiple forms of verification before completing a transaction. This significantly reduces the risk of unauthorized access and enhances overall security.24/7 Monitoring and Response Team

Orum Fintech maintains a dedicated team that monitors transactions round the clock for any suspicious activities. In case of any potential fraud, this team can take immediate action to investigate and mitigate the risk, ensuring minimal impact on customers.Partnerships and Collaborations for Enhanced Security

Establishing strategic partnerships is crucial for Orum Fintech to enhance payment security and stay ahead of potential threats. By collaborating with other entities in the fintech industry, Orum Fintech is able to leverage expertise and resources to strengthen security measures and ensure the safety of transactions.

Strategic Partnerships for Enhanced Security

Orum Fintech has forged partnerships with leading cybersecurity firms to implement cutting-edge technologies and best practices in payment security. By working together with these firms, Orum Fintech can access state-of-the-art tools and solutions to protect customer data and prevent fraudulent activities.

Collaborations in the Fintech Industry

Collaborations with other players in the fintech industry, such as payment processors and financial institutions, enable Orum Fintech to establish secure networks for seamless transactions. By sharing information and insights with these partners, Orum Fintech can identify and address potential vulnerabilities in the payment ecosystem, ensuring a robust security infrastructure.

Future Trends in Payment Security for Fintech

The landscape of payment security in the fintech industry is constantly evolving, driven by advancements in technology and the increasing sophistication of cyber threats. As Orum Fintech continues to prioritize the security of financial transactions, it is essential to anticipate and adapt to future trends that will shape the industry.Impact of Blockchain Technology

Blockchain technology has the potential to revolutionize payment security standards by providing a decentralized and immutable ledger for transactions. By utilizing blockchain, Orum Fintech can enhance transparency, traceability, and security in payment processes. The implementation of smart contracts can automate verification and reduce the risk of fraud, ultimately improving the overall security of financial transactions.Integration of Artificial Intelligence

Artificial intelligence (AI) plays a crucial role in detecting and preventing fraudulent activities in real-time. Machine learning algorithms can analyze vast amounts of data to identify patterns and anomalies that may indicate suspicious behavior. By integrating AI-driven solutions, Orum Fintech can strengthen its fraud prevention measures and enhance the security of payment transactions for customers.Biometric Authentication

The adoption of biometric authentication methods, such as fingerprint recognition and facial recognition, offers an additional layer of security for payment transactions. Biometric data is unique to each individual, making it a highly secure form of authentication. Orum Fintech can leverage biometric technologies to enhance user verification processes and prevent unauthorized access to financial accounts.Tokenization of Payment Data

Tokenization replaces sensitive payment information with a unique token that is meaningless to unauthorized users. This method reduces the risk of data breaches and minimizes the exposure of sensitive data during transactions. By implementing tokenization techniques, Orum Fintech can safeguard customer data and ensure secure and encrypted payment processes.Enhanced Regulatory Compliance

As regulatory requirements continue to evolve, Orum Fintech must stay abreast of compliance standards to maintain the highest level of security for payment transactions. Adhering to industry regulations and standards ensures that the company meets legal requirements and follows best practices for data protection and security.Final Summary

In conclusion, the intricate tapestry of Orum Fintech and Payment Security Standards weaves a narrative of innovation and resilience in the face of evolving threats. This summary encapsulates the key takeaways, leaving readers with a sense of anticipation for what lies ahead in the dynamic landscape of fintech security.

FAQ Section

What are the core services provided by Orum Fintech?

Orum Fintech offers services such as secure payment processing, fraud prevention, and data encryption to ensure seamless transactions.

Why is adhering to payment security standards important in the fintech industry?

Adhering to payment security standards is crucial to safeguard sensitive financial information, build trust with customers, and mitigate the risk of cyber threats.

What technologies does Orum Fintech utilize for ensuring payment security?

Orum Fintech leverages technologies like encryption algorithms, tokenization, and multi-factor authentication to enhance transaction security and prevent fraud.

How does data encryption play a role in securing transactions for Orum Fintech?

Data encryption ensures that sensitive financial data is encoded during transmission, protecting it from unauthorized access and reducing the risk of data breaches.

What future trends in payment security might Orum Fintech need to adapt to?

Orum Fintech may need to adapt to emerging technologies like blockchain and AI to stay ahead of evolving cyber threats and enhance payment security standards in the future.