Embark on a journey into the realm of legacy planning with Multi Family Office Services. Delve into the intricacies of preserving and passing on wealth through personalized strategies and innovative technology integration.

Explore the core components that set multi-family offices apart, offering tailored investment management and estate planning services for a seamless legacy planning experience.

Overview of Multi Family Office Services for Legacy Planning

Multi-family office services for legacy planning encompass a comprehensive approach to managing and preserving wealth across generations within a single family or multiple families. These services go beyond traditional financial planning to address the unique needs and goals of high-net-worth individuals and families.

Importance of Legacy Planning in Multi Family Offices

Legacy planning plays a crucial role in multi-family offices as it involves creating a roadmap for the transfer of wealth, values, and assets to future generations. It aims to ensure that the family's legacy is preserved and that wealth is managed effectively to support the financial well-being of heirs.

Differences Between Multi-Family Offices and Traditional Financial Planning Services

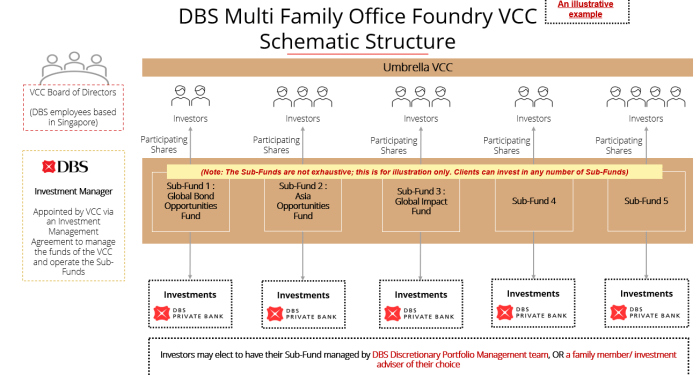

Multi-family offices offer a personalized and holistic approach to wealth management, catering to the specific requirements of affluent families. Unlike traditional financial planning services, multi-family offices provide a wide range of services such as investment management, tax planning, estate planning, philanthropic advising, and family governance.

Core Components of Multi Family Office Services

Multi family offices offer a range of specialized services tailored for legacy planning, ensuring the preservation and growth of family wealth for future generations.Key Services Offered

- Financial Planning: Multi family offices assist in creating comprehensive financial plans that align with the family's long-term goals and values.

- Investment Management: They provide customized investment strategies designed to optimize returns while minimizing risks, considering the specific needs of legacy planning.

- Estate Planning: Multi family offices help families develop strategies to efficiently transfer wealth to future generations, including minimizing estate taxes and ensuring assets are distributed according to the family's wishes.

Investment Management Strategies

Multi family offices employ a variety of investment management strategies specifically tailored for legacy planning:- Diversification: By spreading investments across different asset classes, sectors, and regions, multi family offices reduce risk and enhance long-term returns for the family's wealth.

- Long-Term Focus: Emphasizing a long-term investment approach helps ensure the preservation and growth of family wealth over multiple generations.

- Impact Investing: Some multi family offices incorporate impact investing strategies, aligning investments with the family's values and objectives, such as supporting sustainable and socially responsible initiatives.

Role of Estate Planning and Wealth Transfer

Estate planning and wealth transfer play a crucial role in multi family office services for legacy planning:- Asset Protection: Through estate planning, multi family offices help families protect their assets from potential risks, ensuring the wealth remains intact for future generations.

- Succession Planning: Multi family offices assist in developing succession plans to facilitate the transfer of leadership and ownership within the family business, ensuring a smooth transition and continuity of operations.

- Philanthropic Giving: Multi family offices can help families establish charitable foundations or trusts to support philanthropic causes, leaving a lasting legacy beyond financial wealth.

Customization and Personalization in Legacy Planning

In legacy planning, multi-family offices go beyond cookie-cutter solutions to provide personalized strategies that cater to the unique needs and goals of each client. This customization ensures that wealth preservation and transfer align with the client's specific wishes and circumstances.

In legacy planning, multi-family offices go beyond cookie-cutter solutions to provide personalized strategies that cater to the unique needs and goals of each client. This customization ensures that wealth preservation and transfer align with the client's specific wishes and circumstances.Personalized Solutions Offered by Multi-Family Offices

- Creation of bespoke trust structures tailored to the family's dynamics and financial situation.

- Development of customized investment portfolios based on risk tolerance, time horizon, and legacy objectives.

- Implementation of tax planning strategies that take into account the individual tax situation of the client.

- Establishment of family governance frameworks to promote effective communication and decision-making across generations.

Importance of Tailored Approaches in Wealth Preservation

Customized legacy planning is crucial in ensuring that the wealth transfer process is smooth, efficient, and in line with the client's values and goals. By tailoring strategies to the unique circumstances of each family, multi-family offices can help mitigate potential conflicts, minimize tax liabilities, and maximize the impact of the legacy for future generations.

Technology Integration in Multi Family Office Services

The use of technology plays a crucial role in enhancing legacy planning services within multi-family offices. By leveraging digital tools and platforms, these offices can efficiently manage investments, estates, and wealth transfer, ensuring a seamless and organized process for their clients.

The use of technology plays a crucial role in enhancing legacy planning services within multi-family offices. By leveraging digital tools and platforms, these offices can efficiently manage investments, estates, and wealth transfer, ensuring a seamless and organized process for their clients.Digital Tools and Platforms for Investment Management

- Investment Tracking Software: Multi family offices utilize sophisticated software to monitor and analyze investment portfolios, allowing for real-time updates and performance evaluations.

- Robo-Advisors: Automated investment platforms help in creating diversified portfolios based on client preferences and risk tolerance, optimizing investment strategies.

- Financial Planning Apps: Mobile applications offer clients easy access to financial information, allowing them to track their investments and goals conveniently.

Digital Tools and Platforms for Estate Planning

- Estate Planning Software: These tools assist in creating and updating legal documents such as wills, trusts, and powers of attorney, streamlining the estate planning process.

- Digital Vault Services: Secure online platforms store important documents and information, ensuring easy access for beneficiaries and executors when needed.

- Estate Planning Apps: Mobile applications provide clients with a comprehensive view of their estate plan, including asset distribution and beneficiary designations.

Benefits and Challenges of Technology Integration

- Benefits:

- Efficiency: Technology streamlines processes, reducing manual errors and saving time for both clients and advisors.

- Accessibility: Clients can access their financial information and documents anytime, anywhere, enhancing transparency and communication.

- Scalability: Digital tools allow multi family offices to handle a larger volume of clients and assets effectively, promoting growth and expansion.

- Challenges:

- Security Concerns: Safeguarding sensitive client data from cyber threats and breaches is a constant challenge for offices utilizing technology.

- Integration Issues: Implementing and integrating new software systems can be complex and require training for staff and clients.

- Client Resistance: Some clients may be hesitant to adopt technology in legacy planning, preferring traditional methods and face-to-face interactions.

Final Thoughts

In conclusion, Multi Family Office Services for Legacy Planning offer a comprehensive approach to securing your family's financial future. With a focus on customization, technology integration, and expert guidance, your legacy is in safe hands.

Frequently Asked Questions

How do multi-family offices differ from traditional financial planning services?

Multi-family offices offer a more personalized approach, focusing on comprehensive wealth management for affluent families, while traditional financial planning services cater to a broader client base.

What role does technology play in legacy planning services within multi-family offices?

Technology is used to streamline investment management, estate planning, and wealth transfer processes, improving efficiency and ensuring accurate record-keeping.

How are legacy planning strategies personalized by multi-family offices?

Multi-family offices tailor strategies based on each client's unique financial goals, family dynamics, and long-term objectives, ensuring a customized approach to wealth preservation.