Exploring the realm of Homeowners Insurance Quote Discounts You May Qualify For, this introduction sets the stage for uncovering various ways homeowners can save on their insurance premiums. From types of discounts to home features that qualify for savings, this overview aims to provide valuable insights for savvy homeowners looking to maximize their coverage while minimizing costs.

Types of Discounts

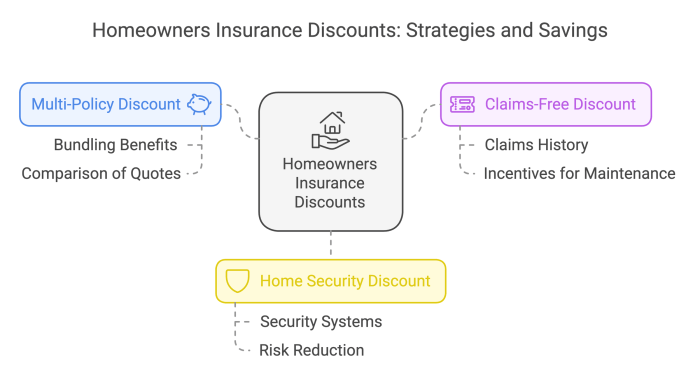

When it comes to homeowners insurance, there are various types of discounts that homeowners may qualify for based on different factors. These discounts can help homeowners save money on their insurance premiums while still maintaining adequate coverage for their properties.Multi-Policy Discount

One common type of discount is the multi-policy discount, which is offered to homeowners who have multiple insurance policies with the same company. By bundling their homeowners insurance with other policies such as auto or life insurance, homeowners can often receive a discount on their premiums.Security System Discount

Homeowners who have installed security systems in their homes may qualify for a security system discount. These systems can include burglar alarms, smoke detectors, or surveillance cameras, which help reduce the risk of theft or damage to the property.New Home Discount

New homeowners may be eligible for a new home discount, which rewards them for purchasing a recently built home. Insurance companies often view newer homes as less risky to insure due to their modern construction and updated features.Claims-Free Discount

Homeowners who have not filed any insurance claims in a certain period may qualify for a claims-free discount. This discount is based on the idea that homeowners who maintain their properties well and avoid making claims are less likely to incur future losses.Discounts for Seniors or Retirees

Some insurance companies offer discounts specifically for seniors or retirees. These discounts may be based on factors such as age, retirement status, or membership in certain organizations.Discounts for Home Improvements

Homeowners who have made certain improvements to their homes, such as installing a new roof, updating electrical systems, or replacing plumbing, may qualify for discounts. These improvements can reduce the risk of damage and make the home safer and more secure.Combined Discounts

In many cases, homeowners can qualify for multiple discounts by meeting the criteria for different types of discounts. For example, a homeowner who has a security system installed in a new home and has a claims-free history may be eligible for both a security system discount and a new home discount, leading to significant savings on their insurance premiums.Home Features Discounts

When it comes to homeowners insurance, specific features of a home can play a significant role in determining the premium rates. Homeowners who have certain features, such as security systems or energy-efficient upgrades, may be eligible for discounts on their insurance policies.Verifying these features is essential to ensure eligibility for discounts. Insurance companies may require documentation or proof of these features, such as receipts for upgrades or installation certificates for security systems. It is important for homeowners to keep these documents handy and provide them when requested by the insurance provider.To proactively enhance their homes and qualify for additional discounts, homeowners can consider investing in security systems, such as burglar alarms, motion-sensor lights, or surveillance cameras. These features not only provide added protection for the home but can also help lower insurance premiums. Energy-efficient upgrades, such as installing smart thermostats, energy-efficient appliances, or improving insulation, can also make a home more eligible for discounts on homeowners insurance.Policyholder Behavior Discounts

When it comes to homeowners insurance, policyholder behavior can play a significant role in determining the discounts you may qualify for. Factors such as a history of timely payments and loyalty to an insurance company can lead to potential discounts on your premium.

Varying Discounts Offered by Different Insurers

It's important to note that different insurance companies may offer varying discounts based on policyholder behavior. While some insurers may prioritize loyalty discounts for long-term customers, others may focus more on rewarding timely payments and responsible behavior.

Tips for Maintaining Behavior for Discounts

- Pay your premiums on time: Ensuring timely payments can not only help you maintain a good payment history but also make you eligible for potential discounts.

- Stay loyal to your insurer: Building a long-term relationship with your insurance company can often result in loyalty discounts over time.

- Review your policy regularly: By reviewing your policy and discussing your coverage needs with your insurer, you can ensure you are getting the best possible rates based on your behavior as a policyholder.

Bundling Discounts

When it comes to saving money on your homeowners insurance, bundling discounts can be a great option. Bundling involves purchasing multiple insurance policies from the same provider, which often results in a discount on each policy.By bundling your homeowners insurance with other types of insurance policies, such as auto insurance or life insurance, you can enjoy significant savings on your overall insurance costs. This is because insurance companies value customer loyalty and are willing to offer discounts to customers who choose to consolidate their insurance needs with them.Insurance Policies to Bundle

When bundling your homeowners insurance, consider combining it with other policies such as:- Auto insurance

- Life insurance

- Renters insurance

- Umbrella insurance

Advantages and Drawbacks

- Advantages:

- Bundling discounts can result in lower overall insurance premiums.

- Convenience of managing all policies with a single insurance provider.

- Potential for increased coverage limits or additional benefits.

- Potential Drawbacks:

- Limitations on policy customization compared to purchasing individual policies from different providers.

- Possibility of higher premiums for bundled policies if one of the bundled policies has a higher risk profile.

- May be restrictions on switching providers for individual policies if bundled.

Final Summary

In conclusion, navigating the landscape of Homeowners Insurance Quote Discounts You May Qualify For opens up a world of possibilities for saving money and optimizing coverage. By understanding the different discount options available, homeowners can make informed decisions to protect their homes and finances effectively.

FAQ Summary

How can I qualify for a bundling discount?

To qualify for a bundling discount, you typically need to purchase multiple insurance policies from the same provider, such as combining your homeowners and auto insurance.

What are some common policyholder behavior discounts?

Policyholder behavior discounts can include discounts for maintaining a good credit score, being claim-free for a certain period, or renewing your policy with the same insurer.

How can I enhance my home to qualify for discounts?

You can enhance your home by installing security systems, upgrading to energy-efficient features, or making renovations that reduce the risk of damage, all of which could make you eligible for discounts.