Embark on a journey into the realm of Divvy Fintech Solutions for Corporate Spending, where efficiency and simplicity converge to redefine how businesses manage their expenses. This passage beckons readers with a promise of insightful knowledge, ensuring a captivating reading experience that is both informative and engaging.

Delve into the details of Divvy Fintech's key features, user interface, budgeting capabilities, security measures, and integration options to discover how this innovative solution transforms corporate spending practices.

Overview of Divvy Fintech Solutions for Corporate Spending

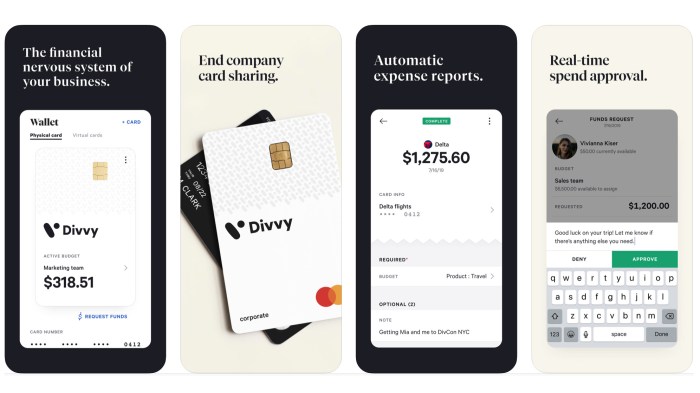

Divvy Fintech Solutions offers a comprehensive platform designed to streamline corporate spending processes, providing efficient solutions for managing expenses within organizations.Key Features of Divvy Fintech Solutions

- Real-time expense tracking

- Virtual cards for easy payments

- Automated expense reports

- Budgeting tools for better financial control

How Divvy Fintech Simplifies Corporate Spending

Divvy Fintech simplifies corporate spending by centralizing all expenses in one platform, eliminating the need for manual data entry and reconciliation. The real-time tracking feature allows for quick visibility into spending patterns, helping businesses make informed financial decisions.Benefits of Using Divvy Fintech

- Increased efficiency in expense management

- Enhanced transparency and control over corporate spending

- Reduced risk of fraud with virtual card technology

- Improved budgeting accuracy and forecasting

Divvy Fintech Software Interface

When accessing the Divvy Fintech software interface, users are greeted with a user-friendly and intuitive platform designed to streamline corporate spending processes efficiently.

When accessing the Divvy Fintech software interface, users are greeted with a user-friendly and intuitive platform designed to streamline corporate spending processes efficiently.Navigation Guide

- The Dashboard: The main hub where users can view an overview of their spending, budgets, and alerts.

- Transactions: A section dedicated to tracking all transactions made through the platform, providing detailed information on each expense.

- Cards: Manage virtual and physical cards, set spending limits, and customize permissions for each cardholder.

- Budgets: Set and monitor budgets for different departments or projects, helping to control expenses effectively.

- Reports: Generate detailed reports on spending patterns, trends, and insights to aid in decision-making.

- Integrations: Connect Divvy Fintech with other software systems for seamless data transfer and synchronization.

Functionality Overview

- Expense Tracking: Easily track and categorize expenses in real-time, ensuring accurate financial records.

- Approval Workflows: Establish customizable approval workflows to streamline the authorization process for expenses.

- Virtual Cards: Generate virtual cards for online purchases, enhancing security and control over transactions.

- Spending Insights: Gain valuable insights into spending patterns and trends to optimize budget allocation.

- Compliance Monitoring: Monitor compliance with company policies and regulations through automated checks and alerts.

Divvy Fintech Solutions for Budgeting and Tracking Expenses

Divvy Fintech offers robust solutions for setting and managing budgets for corporate spending, as well as tracking expenses in real-time to ensure transparency and control over financial activities.Setting and Managing Budgets

- Divvy Fintech allows users to create customized budgets for different departments or projects within the organization.

- Users can set spending limits, allocate funds, and track expenses against the budget in real-time.

- The platform provides alerts and notifications when budgets are close to being exceeded, enabling proactive measures to be taken.

Tracking Expenses in Real-Time

- Divvy Fintech offers a user-friendly interface that allows employees to submit expenses instantly through the mobile app or web portal.

- Managers can view and approve expenses in real-time, ensuring timely reconciliation and accurate financial reporting.

- The platform integrates with accounting software to streamline expense management and ensure data accuracy.

Analyzing Spending Patterns and Trends

- Divvy Fintech provides detailed analytics and reporting tools to help businesses analyze spending patterns and identify trends.

- Users can generate customized reports to gain insights into where the company is spending money and make informed decisions based on data.

- The platform offers visual representations of data, such as graphs and charts, to facilitate easy understanding of financial information.

Security Measures in Divvy Fintech Solutions

Divvy Fintech takes security seriously and has implemented robust measures to protect sensitive financial data and ensure secure transactions.

Data Encryption

Divvy Fintech utilizes advanced encryption techniques to secure all data transmitted through its platform. This ensures that sensitive information such as payment details and personal data are protected from unauthorized access.

Authentication Processes

Divvy Fintech employs multi-factor authentication to verify the identity of users and prevent fraudulent activities. This includes the use of passwords, security tokens, and biometric verification to ensure that only authorized individuals can access sensitive information and perform transactions.

Integration Capabilities of Divvy Fintech with Corporate Systems

Divvy Fintech offers various integration options to connect with existing corporate systems, ensuring a seamless experience for users. By integrating Divvy Fintech with other tools, companies can streamline their operations and improve efficiency.

Compatibility with Different Accounting and Financial Software

- Divvy Fintech is compatible with popular accounting software such as QuickBooks, Xero, and NetSuite, allowing for easy data transfer and synchronization.

- The software also integrates with financial management tools like Expensify and Bill.com, enhancing the overall financial workflow within the organization.

Benefits of Integration with Corporate Tools

- Improved Data Accuracy: Integrating Divvy Fintech with other corporate systems reduces manual data entry errors and ensures accurate financial information.

- Enhanced Reporting Capabilities: By connecting Divvy Fintech with reporting tools, companies can generate comprehensive reports that provide valuable insights for decision-making.

- Increased Efficiency: Integration with other corporate tools automates processes, saving time and resources while improving overall productivity.

- Seamless Workflow: Integration allows for a seamless flow of data between different systems, eliminating silos and promoting collaboration across departments.

Conclusion

In conclusion, Divvy Fintech Solutions for Corporate Spending offers a comprehensive toolkit for businesses to streamline their financial operations, enhance security, and gain valuable insights into their expenditure patterns. With its user-friendly interface and robust features, Divvy Fintech stands as a beacon of efficiency in the realm of corporate expense management.

Clarifying Questions

How does Divvy Fintech simplify corporate spending processes?

Divvy Fintech streamlines corporate spending by offering real-time expense tracking, intuitive budgeting tools, and seamless integration with existing systems.

What security measures does Divvy Fintech employ to protect financial data?

Divvy Fintech employs robust security protocols, secure transactions, data encryption, and stringent authentication processes to safeguard sensitive financial information.

Can Divvy Fintech integrate with different accounting software?

Yes, Divvy Fintech is compatible with a variety of accounting and financial software, ensuring smooth integration for enhanced operational efficiency.