Auto Insurance Quote and Coverage Limits Explained lay the foundation for this informative discussion, offering readers a deep dive into the intricacies of auto insurance with a blend of casual formal language style and originality.

The subsequent paragraphs will delve into the key aspects of auto insurance quotes and coverage limits to provide a thorough understanding of the topic.

Auto Insurance Quote

When it comes to obtaining an auto insurance quote, there are several factors that insurance companies take into consideration. These factors can vary depending on the insurance provider, but there are some common elements that tend to influence the cost of your insurance premium.Factors Influencing Auto Insurance Quote

- Your driving record: If you have a history of accidents or traffic violations, you may be considered a higher risk and, therefore, may receive a higher insurance quote.

- Type of vehicle: The make, model, and year of your vehicle can impact your insurance premium. More expensive or high-performance vehicles may cost more to insure.

- Age and experience: Younger drivers or those with less experience on the road may face higher insurance rates due to the perceived higher risk.

- Location: Where you live and where you park your car can also affect your insurance quote. Urban areas or areas with higher crime rates may result in higher premiums.

- Coverage limits: The amount of coverage you choose will impact your insurance quote. Higher coverage limits will generally result in a higher premium.

Examples of Impact on Insurance Quotes

- For example, a new driver with a sports car may face a much higher insurance quote compared to an experienced driver with a minivan.

- Similarly, someone with a clean driving record may receive a lower insurance quote than someone with multiple accidents on their record.

Importance of Getting Multiple Quotes

- It is essential to get multiple quotes from different insurance providers to compare prices and coverage options. This allows you to find the best policy that meets your needs at a competitive price.

- By shopping around and getting multiple quotes, you can ensure that you are not overpaying for your auto insurance and that you are receiving the coverage you need.

Coverage Limits Explained

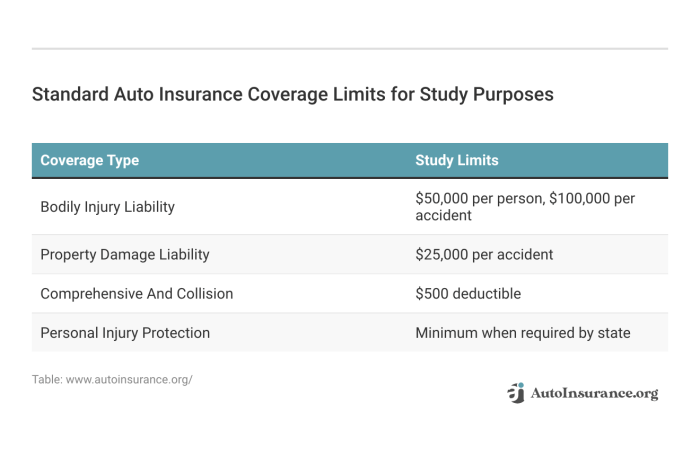

When it comes to auto insurance, coverage limits refer to the maximum amount that an insurance policy will pay out for a specific type of coverage in the event of a claim. These limits are set by the policyholder when purchasing insurance and can vary depending on the type of coverage selected.

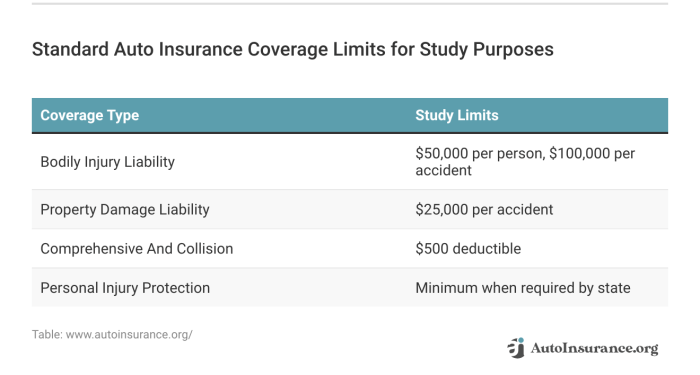

When it comes to auto insurance, coverage limits refer to the maximum amount that an insurance policy will pay out for a specific type of coverage in the event of a claim. These limits are set by the policyholder when purchasing insurance and can vary depending on the type of coverage selected.Types of Coverage Limits

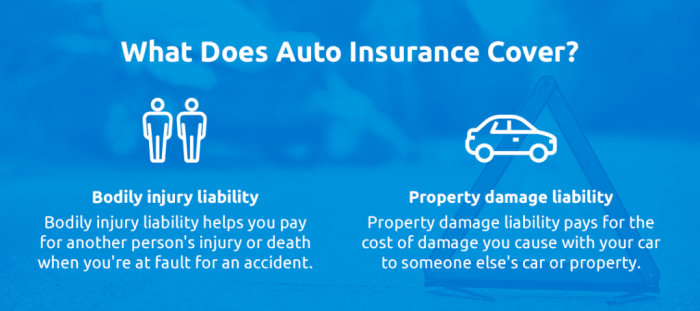

- Liability Coverage: This type of coverage pays for damages and injuries that you are legally responsible for in an accident.

- Comprehensive Coverage: Comprehensive coverage helps pay for damage to your car that is not caused by a collision, such as theft, vandalism, or natural disasters.

- Collision Coverage: Collision coverage pays for damage to your car in the event of a collision with another vehicle or object.

Implications of High vs. Low Coverage Limits

Having high coverage limits means that you will be protected in case of a major accident or incident, but it also usually comes with higher premiums. On the other hand, low coverage limits may make your insurance more affordable, but could leave you financially vulnerable if the damages exceed your coverage limits.

Selecting the Right Coverage

When it comes to selecting the right coverage for your auto insurance policy, it's essential to consider your individual needs and circumstances. Understanding how to determine the appropriate coverage limits can help ensure you have adequate protection in case of an accident or other unforeseen events.

When it comes to selecting the right coverage for your auto insurance policy, it's essential to consider your individual needs and circumstances. Understanding how to determine the appropriate coverage limits can help ensure you have adequate protection in case of an accident or other unforeseen events.Determining the Right Coverage Limits

- Assess your assets: Consider the total value of your assets, including your home, savings, and investments. Your coverage limits should be sufficient to protect these assets in case of a lawsuit resulting from a car accident.

- Evaluate your driving habits: If you have a long commute or frequently drive in high-traffic areas, you may want to consider higher coverage limits to protect yourself in case of an accident.

- Consider your budget: While it's important to have adequate coverage, you also need to consider what you can afford. Balance your coverage limits with your budget to find the right level of protection.

Understanding State-Mandated Minimum Coverage Requirements

- Each state has its own minimum requirements for auto insurance coverage. It's crucial to understand these requirements to ensure you are compliant with the law.

- State-mandated minimum coverage may not be enough to fully protect you in case of a serious accident. Consider purchasing additional coverage beyond the minimum requirements for added protection.

- Failure to maintain the state-mandated minimum coverage can result in fines, license suspension, and other penalties. Make sure you are aware of and meet your state's requirements.

Choosing Appropriate Coverage Limits: A Hypothetical Scenario

Let's say you have a home worth $300,000, savings of $50,000, and investments totaling $100,000. You have a long commute to work and frequently drive on busy highways. In this scenario, it would be wise to opt for higher coverage limits to protect your assets and yourself in case of an accident. Consider comprehensive coverage and higher liability limits to ensure you are adequately covered.Coverage Options

When it comes to auto insurance, there are additional coverage options beyond the basic liability coverage that can provide added protection and peace of mind for drivers. Two common types of coverage that can be added to an auto insurance policy are comprehensive and collision coverage.Comprehensive Coverage

Comprehensive coverage helps protect you from damages to your vehicle that are not caused by a collision with another vehicle. This can include incidents such as theft, vandalism, natural disasters, or hitting an animal on the road. By adding comprehensive coverage to your policy, you can ensure that you are covered in a wide range of scenarios that may not be covered by basic liability insurance alone.Collision Coverage

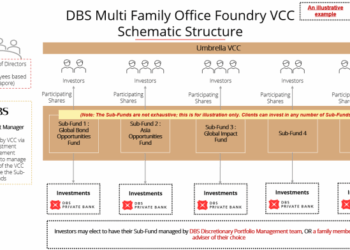

Collision coverage, on the other hand, helps pay for damages to your vehicle that result from a collision with another vehicle or object. Whether you are at fault or not, collision coverage can help cover the cost of repairs or even replace your vehicle if it is deemed a total loss. This type of coverage is especially important for newer vehicles or vehicles that are still being financed.Umbrella Policies

Umbrella policies play a crucial role in enhancing coverage limits beyond what is provided by basic auto insurance policies. These policies provide additional liability coverage that goes above and beyond the limits of your auto insurance policy. Umbrella policies can offer coverage for various situations, such as a costly lawsuit resulting from a severe accident where your basic liability coverage may fall short. By having an umbrella policy in place, you can further protect yourself and your assets in case of unexpected events.Closing Summary

In conclusion, Auto Insurance Quote and Coverage Limits Explained sheds light on the complexities of insurance policies, empowering readers to make informed decisions when selecting coverage options.

FAQ

What factors influence auto insurance quotes?

Auto insurance quotes are influenced by factors such as driving record, vehicle type, age, and location. Insurers use these factors to assess the risk associated with insuring a particular driver.

How do coverage limits affect auto insurance policies?

Coverage limits determine the maximum amount an insurance company will pay for a covered claim. Higher coverage limits offer more protection but come with higher premiums.

What are state-mandated minimum coverage requirements?

State-mandated minimum coverage requirements are the minimum amount of auto insurance coverage drivers must carry to legally operate a vehicle in a specific state.

What are umbrella policies in auto insurance?

Umbrella policies provide additional liability coverage beyond the limits of a standard auto insurance policy. They offer protection in cases where liability claims exceed the primary policy limits.