Exploring the differences between Credit Card Consolidation Loan and Personal Loans, this article delves into the intricacies of each financial option to help you make informed decisions.

As we navigate through the details, you'll gain valuable insights into which option suits your financial needs best.

Credit Card Consolidation Loan

When it comes to managing credit card debt, a credit card consolidation loan can be a helpful solution. This type of loan allows you to combine multiple credit card balances into a single loan, making it easier to keep track of payments and potentially lowering your overall interest rate.

When it comes to managing credit card debt, a credit card consolidation loan can be a helpful solution. This type of loan allows you to combine multiple credit card balances into a single loan, making it easier to keep track of payments and potentially lowering your overall interest rate.Benefits of Credit Card Consolidation Loan

- Lower Interest Rates: By consolidating your credit card debt with a loan, you may qualify for a lower interest rate than what you are currently paying on your credit cards. This can help you save money in the long run.

- Simplified Payments: Instead of juggling multiple credit card payments each month, a consolidation loan allows you to make a single monthly payment towards your debt. This can make budgeting and managing your finances more straightforward.

- Potential Credit Score Improvement: Paying off your credit card debt with a consolidation loan can also have a positive impact on your credit score. By reducing your credit utilization ratio and making on-time payments, you can improve your creditworthiness over time.

Lenders Offering Credit Card Consolidation Loans

- Discover Personal Loans: Discover offers personal loans that can be used for consolidating credit card debt. They provide fixed rates and flexible repayment terms.

- SoFi: SoFi is another lender that offers personal loans for debt consolidation. They have competitive rates and no origination fees.

- LendingClub: LendingClub provides personal loans for consolidating credit card debt. They offer a simple online application process and quick funding.

Personal Loans

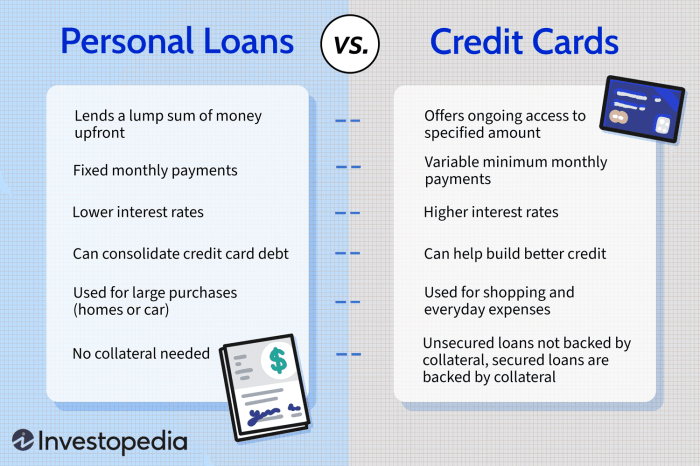

A personal loan is a type of loan that allows individuals to borrow a lump sum of money from a financial institution, such as a bank or credit union, for various purposes. These purposes can range from consolidating debt, making home improvements, or covering unexpected expenses.

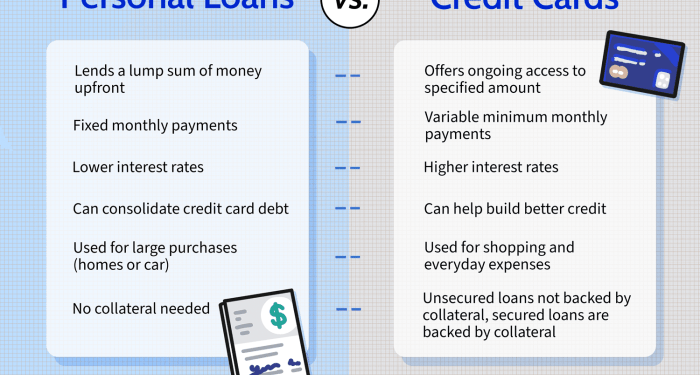

Comparison with Credit Card Consolidation Loans

- Personal loans typically have fixed interest rates and monthly payments, providing borrowers with a predictable repayment schedule. In contrast, credit card consolidation loans may have variable interest rates and minimum monthly payments that can fluctuate.

- Personal loans have a specific term, usually ranging from 1 to 7 years, whereas credit card consolidation loans may have more flexible repayment terms.

- Personal loans are unsecured, meaning they do not require collateral, while credit card consolidation loans may be secured by assets such as a home or car.

Interest Rates and Terms

Interest rates for personal loans can vary depending on the borrower's creditworthiness, with average rates ranging from 6% to 36%. Loan terms typically range from 1 to 7 years, with the option to repay the loan early without incurring prepayment penalties. Additionally, personal loans may have origination fees ranging from 1% to 8% of the loan amount.

Eligibility Criteria

When applying for credit card consolidation loans or personal loans, meeting the eligibility criteria is crucial to secure approval. Let's explore the common requirements and factors considered by lenders for both types of loans, along with tips on how to improve eligibility.Credit Card Consolidation Loans

- Good credit score: Lenders typically look for a credit score of 600 or higher.

- Stable income: Demonstrating a steady source of income is essential to show repayment capability.

- Low debt-to-income ratio: A lower ratio indicates better financial health and increases the chances of approval.

Personal Loans

- Credit history: Lenders assess your credit history to determine your repayment behavior.

- Income and employment: Having a stable job and sufficient income are crucial factors for approval.

- Debt-to-income ratio: A lower ratio signifies better financial management and enhances eligibility.

Tips to Improve Eligibility

- Improve credit score: Make timely payments, reduce outstanding debts, and check for any errors in your credit report.

- Increase income: Consider additional sources of income or negotiate a raise at work to boost your financial stability.

- Reduce debts: Pay off existing debts to lower your debt-to-income ratio and show responsible financial behavior.

- Provide collateral: Offering collateral can strengthen your loan application and improve your chances of approval.

Application Process

When applying for a credit card consolidation loan or a personal loan, there are specific steps involved in the application process. Here, we will Artikel the steps for each type of loan and the documentation needed, as well as discuss the timeline for approval and disbursement of funds.Credit Card Consolidation Loan Application

- Fill out an application form provided by the financial institution offering the loan.

- Submit necessary documents such as proof of income, credit card statements, and identification.

- Wait for the financial institution to review your application and determine eligibility.

- If approved, review and sign the loan agreement provided by the institution.

- Upon signing, the funds will be disbursed to pay off your credit card debts.

Personal Loan Documentation

- Proof of identity such as a government-issued ID.

- Proof of income like pay stubs or tax returns.

- Credit history report to assess creditworthiness.

- Other documents may be required based on the lender's specific requirements.

Approval and Disbursement Timeline

- Credit card consolidation loans typically have a quicker approval process since the funds are used to pay off existing debts.

- Once approved, the funds for a credit card consolidation loan are usually disbursed within a few business days.

- Personal loans may take longer for approval as they involve a more thorough review of the borrower's financial situation.

- Disbursement of funds for personal loans can vary but is generally within 1-2 weeks after approval.

Last Recap

In conclusion, understanding the nuances of Credit Card Consolidation Loan vs Personal Loans empowers you to manage your debt effectively and pave the way towards financial stability.

Key Questions Answered

What are the key differences between a Credit Card Consolidation Loan and a Personal Loan?

Credit Card Consolidation Loans are specifically designed to consolidate credit card debt, while Personal Loans can be used for various purposes beyond debt consolidation.

How do interest rates typically differ between the two types of loans?

Credit Card Consolidation Loans may have lower interest rates compared to Personal Loans, which often carry higher rates due to the unsecured nature of the loan.

What factors influence eligibility for a Credit Card Consolidation Loan?

Factors such as credit score, income, and debt-to-income ratio play a significant role in determining eligibility for a Credit Card Consolidation Loan.

Is it possible to get a Personal Loan for the purpose of consolidating credit card debt?

Yes, some lenders offer Personal Loans specifically for debt consolidation, allowing borrowers to use the funds to pay off credit card debt.

How long does it typically take to receive funds after approval for each type of loan?

Credit Card Consolidation Loans may disburse funds quicker than Personal Loans, which can take a few days to a week for approval and funding.